Commenced on 1 March 2024, these Regulations ban smoking in early childhood service facilities, children's services facility hospitals, underage sporting events and other specified premises.

Further commenced on 1 March 2024, the Act, among others, implements relevant findings of the thematic review of insurance instruments that are due to sunset on 1 October 2023.

Commenced on 1 March 2024, this Amendment Act creates requirements regarding advance care directives and eligibility requirements for interpreters.

Commenced on 6 March 2024, this Amendment Act creates a new Pacific Engagement Visa (PEV) which offers permanent residency to eligible citizens of participating Pacific Island countries and Timor-Leste, and their immediate family members, in order to further engagement with Pacific nations and provide opportunities for cultural, business, educational, and skills exchange.

Further commenced on 14 March 2024, this Amendment Act makes a variety of amendments to ensure the ACT’s building regulatory system can be effectively regulated and comply with building standards under the building and construction industry.

Commenced on 14 March 2024, this Amendment Act enables content providers to use accredited classifiers to self-classify film and computer game content and extends the powers of the Classification Board to quality assure industry self-classification decisions.

Further commenced on 15 March 2024, this Act supports the enactment of the Financial Accountability Regime Act 2023 (Cth) and gives effect to the transitional arrangements, consequential amendments and the repeal of the existing Banking Executive Accountability Regime.

Commenced on 25 March 2024, the Amendment Act implements national reforms to the management of certain chemicals.

Commenced on 26 March 2024, this Amendment Act amends the Paid Parental Leave Act 2010 (Cth) to increase the maximum parental leave pay entitlement to improve flexibility and access to the Paid Parental Leave scheme to better support the needs of working parents and carers.

Partially commenced on 28 March 2024, this Amendment Act sets out various obligations, including signage requirements for advertisement of gambling services, due diligence duties, issuance of exclusion notices and sharing of exclusions information among casino operators.

Fully commenced on 1 April 2024, this Amendment Act sets out, among others, factors for high-quality early childhood education and eligibility requirements for registration as an early childhood teacher.

Commenced on 3 April 2024, this Amendment Act implements a number of recommendations arising from an independent statutory review of the Ageing and Disability Commissioner Act 2019 (NSW), and requires a service provider to give certain information about the provider and visitable services of the provider to the Commissioner.

Commenced on 3 April 2024, this Amendment Act amends the Children and Young Persons (Care and Protection) Act 1998 (NSW) in relation to the extraterritorial application of the Act to children and young persons outside of NSW.

Commenced on 4 April 2024, this Amendment Act amends the Gas Supply Act 2003 (Qld) to expand its jurisdiction to hydrogen, hydrogen blends, biomethane and other gases, and also amends the Petroleum and Gas (Production and Safety) Act 2004 (Qld).

Commenced on 9 April 2024, this Amendment Act enables the continuation of terrestrial community television to audiences in Melbourne and Adelaide beyond the current expiry date of 30 June 2024, and provides the Australian Communications and Media Authority with certain instrument-making powers.

Partially commenced on 9 April 2024, this Act amends the Corporations Act 2001 (Cth), the Income Tax Assessment Act 1936 (Cth), the Income Tax Assessment Act 1997 (Cth) and the Taxation Administration Act 1953 (Cth) to introduce new rules to protect the integrity of the Australian tax system and improve tax transparency.

Commenced on 9 April 2024, this Amendment Act amends the Autonomous Sanctions Act 2011 (Cth) to explicitly confirm that individuals or entities can be validly sanctioned based on past conduct or status.

Fully commenced on 11 April 2024, this Amendment Act increases penalities of certain offences under the Energy Resources Act 2000 (SA), particularly in relation to the alteration of pipelines.

Commenced on 11 April 2024, this Amendment Act amends the Discrimination Act 1991 (ACT), the Children and Young People Act 2008 (ACT), and the Human Rights Commission Act 2005 (ACT) to extend protections in which discrimination is prohibited, limit the exceptions of discrimination, and provide for the permitted discriminations against a person.

Partially commenced on 15 April 2024, this Amendment Act expands building contractor registrations, amends the schedule of prescribed fees for registration, and expands powers for the introduction of a continuing professional development scheme.

Partially commenced on 20 April 2024, this Amendment Act amends the Liquor Act 2010 (ACT) to create a more flexible regulatory framework for businesses operating in the night-time economy, as well as giving Access Canberra greater flexibility in administering the Act.

Partially commenced on 20 April 2024, this Amendment Act will, among others, increase the maximum penalty for bodies corporate for the offence of industrial manslaughter.

Partially commenced on 22 April 2024, this Amendment Act amends the Livestock Disease Control Act 1994 (Vic), the Plant Biosecurity Act 2010 (Vic), and the Livestock Management Act 2010 (Vic) to provide for compensation payments and prescribe increased penalties for offences related to exotic animal diseases.

Partially commenced on 23 April 2024, this Amendment Act amends the Electricity Industry Act 2004 (WA), the Electricity Act 1945 (WA) and the Electricity Industry Amendment (Distributed Energy Resources) Act 2024 (WA) to implement the alternative electricity services registration framework. Specifically, it outlines how organisations obtain the necessary licenses or registrations to operate, prescribes penalties for non-compliance, and provides for the joining fees and annual levies for licensed electricity retailers.

Partially commenced on 26 April 2024, this Amendment Act has been made to address current housing challenges through a suite of new tools, and improve operational and process aspects of several planning Acts.

Commenced on 1 May 2024, this Amendment Act amends the Competition and Consumer Act 2010 (Cth) (the Act) to expand the functions of the Australian Competition and Consumer Commission and establish a designated complaints function.

Partially commenced on 2 May 2024, this Act adopts a national approach to the regulation of marine safety in relation to domestic commercial vessels in Western Australia.

Commenced on 7 May 2024, this Amendment Act amends the Family Law Act 1975 (Cth) to give effect to the key aspects of the National Strategic Framework for Information Sharing between the Family Law and Family Violence and Child Protection Systems.

Commenced on 16 May 2024, this Amendment Act which amends the Electricity Safety Act 1998 (Vic), the Gas Safety Act 1997 (Vic) and the Pipelines Act 2005 (Vic) to provide the duties for owners and operators of electrical, gas and pipeline installations, and prescribes penalties for non-compliance.

Fully commenced on 17 May 2024, this Amendment Act amends several instruments to improve Australia's Intellectual Property system. In particular, it shortens the grace period for the renewal of trade mark registration and provides for the authority of the Registrar of Trade Marks to communicate trade mark decisions.

Commenced on 26 May 2024, these Regulations require an employer to keep and make available records in relation to the employment of a child, and prescribe infringement offences and corresponding penalties under the Child Employment Act 2003 (Vic).

Commenced on 1 June 2024, this Amendment Act amends the Telecommunications Act 1997 (Cth), the Telecommunications (Consumer Protection and Service Standards) Act 1999 (Cth) and the Competition and Consumer Act 2010 (Cth) to refine the operation of the statutory infrastructure provider regime.

Commenced on 3 June 2024, this Act establishes the State Emergency Service to provide emergency services in the State and other related services to government entities and the community.

Fully commenced on 11 June 2024, this Amendment Act amends the Gambling Act 2001 (Cth) to reduce gambling harms by prohibiting the operator of a regulated interactive gambling service from accepting or offering to accept payments through credit cards, credit-related products, and digital currency for interactive wagering services, and prescribes penalties for non-compliance.

Retrospectively commenced on 1 July 2023, this Amendment Act provides the exemption requirements for those applying for land tax exemption for build-to-rent developments.

Fully commenced on 1 July 2024, this Amendment Act amends the Gaming and Liquor Administration Act 2007 (NSW), the Liquor Act 2007 (NSW) and the Liquor Regulation 2018 (NSW) to make miscellaneous amendments to increase the vibrancy of the night-time economy. Specifically, it removes unrestricted club licence for certain premises, extends the trading hours for prescribed venues, and prescribes the conditions for the authorisation to sell liquor for consumption away from licensed premises.

Partially commenced on 1 July 2024, this Amendment Act amends various transport-related Acts to ensure their continued effective and efficient operation. It establishes a method for consultation for road authorities, utilities and public transport providers, and provides the requirements in relation to the vehicle sharing scheme.

Fully commenced on 1 July 2024, this Amendment Act amends, among others, the Tax Agent Services Act 2009 (Cth) and the Taxation Administration Act 1953 (Cth) in response to the PwC tax leaks scandal. Specifically, it provides for the enhanced information sharing of taxation officers of specified protected information, the expanded tax promoter penalty laws and the increased penalties for promoting tax exploitation scheme, and the expanded whistleblower protections regarding disclosures and increased investigation timeframe for investations in relation to the Tax Practitioners Board.

Fully commenced on 1 July 2024, this Amendment Act amends the National Vocational Education and Training Regulator Act 2011 (Cth) to address the integrity risks posed by non-genuine or unscrupulous National VET Regulator registered training organisations, particularly in relation to making false or misleading representation in advertisement or making false or misleading representation relating to VET course, VET qualification or operations.

Fully commenced on 1 July 2024, this Amendment Act amends the Disability Act 2006, among others, to strengthen rights, protections and safeguards for people with disability in Victoria, including to prescribe a penalty in relation to the disclosure, use or transfer of protected information relating to disability services or disability service providers.

Partially commenced on 1 July 2024, this Act establishes a scheme for the registration of short-term rental accommodation, including prescribing penalties for specified offences, and makes consequential amendments to the Fair Trading Act 2010 (WA).

Fully commenced on 1 July 2024, this Amendment Act amends the Work Health and Safety (WHS) Act 2011 (NSW) and the Work Health and Safety Regulation 2017 (NSW) to incorporate amendments made to the national Model Work Health and Safety Act and the Model Work Health and Safety Regulations, including to extend the criminal liability for specified gross negligence or reckless conduct, and increase the maximum penalties for specified offences.

Fully commenced on 1 July 2024, this Amendment Act amends several instruments to increase penalties for certain environmental offences, including those relating to asbestos waste and for non-compliance with orders from the Authority, outline the powers of the Authority to order notices, and provide for the circumstances in which an environment protection licence may be varied.

Fully commenced on 1 March 2024, this Act establishes a new regulatory regime for Financial Market Infrastructures, including those relating to required contingency plans and entities subject to statutory management.

Commenced on 6 March 2024, this Amendment Act, among others, removes requirements for retailers of smoked tobacco products to apply to, and be approved by, the Director-General of Health before selling smoked tobacco products.

Commenced on 1 April 2024, these Amendment Regulations set out, among others, requirements for registration as an adventure activity operator, and duties including to inform of serious risks to the participant’s health or safety.

Commenced on 25 April 2024, these Amendment Regulations amend the Credit Contracts and Consumer Finance Regulations 2004 (NZ) to provide for two new exemptions under the Credit Contracts and Consumer Finance Act 2003 (NZ), specifically to exempt VTR schemes from the consumer credit contract requirements, and exempt the original lender from the annual return requirement in the Act.

Partially commenced on 1 July 2024, this Act amends several instruments to help reduce the cost-of-living pressures by providing tax relief and additional support to low- and middle-income individuals and families by providing the eligibility criteria and application processes for various tax credits, the reporting and disclosure requirements related to the new FamilyBoost tax credit, and the interest rate calculations for student loan borrowers based overseas.

Partially commenced 1 July 2024, this Act amends several instruments to set the annual rates of income tax for the 2023-2024 year, improve tax settings within a low-rate framework for income tax, and improve settings for tax administration, KiwiSaver, and child support rules administered by the Inland Revenue Department.

The New Zealand Facilities Management obligations register provides guidance for New Zealand organisations that own, occupy or control workplaces, public premises, electrical installations and works, gas and LPG systems, water systems, waste systems and facilities, car parks, major hazard sites and heritage sites. The register covers how facility owners, operators, and managers are obligated to coordinate with various government agencies to achieve compliance with applicable legislation. This includes working with WorkSafe NZ during investigations and inspections, providing evacuation schemes and other required information to Fire and Emergency NZ, collaborating with local councils for consent and certification processes and coordinating with regulatory bodies such as the Environmental Protection Authority when managing hazardous substances, or Heritage New Zealand for sites of cultural significance.

A new set of obligations have been added to cover the requirements under the AFIA Online Small Business Lenders Code of Practice

New content added to cover the regulation of medication administration by authorised practitioners

New content added covering critical infrastructure regulatory requirements for telecommunications organisations

New content added to cover Cyber sanctions

A new set of obligations have been added to provide more granular coverage of the requirements for engaging in debt collection activities under RG 96 and the National Consumer Credit Protection Act 2009 (Cth)

New content added on Reporting requirements for registered financial corporations and dedicated coverage of Misleading or deceptive conduct and representations

A new set of obligations have been added to provide dedicated coverage of the requirements for complying with the Financial Services Council Standards and guidance notes

New topic on the requirements for maintaining a casino licence was added, including coverage of controlled contracts, casino agreements and adherence to state government directions

A new set of obligations have been added to cover the data reporting requirements for RFCs/non-ADI lenders

New content added covering an employer's obligations to prevent and eliminate harassment in the workplace

New content added covering Home Loans and Reverse Mortgages, and Short-term and Small Amount Credit Contracts

New content was added covering the State and Territory specific rules and regulations pertaining to the use of restrictive practices by registered NDIS providers

New content added to cover waste levies across jurisdictions and reuse and recycling coverage including container deposit schemes and waste or resource recovery activities

Additional obligations were added to provide more granular coverage of RG 271

A new set of obligations have been added to cover the community consultation obligations under Part 2 Division 2, the staffing obligations under Part 2 Division 3, and the code of conduct obligations under Part 2 Division 4 of the Ports Authority Act

New content was added to cover Successor Fund Transfers and Assignments and charges over fund assets

New topic covering the SOCI requirements of transportation organisations

New content added on operational transportation service and facility agreements, register of transportation facilities, East Coast Gas System disclosure obligations, and updated content on capacity auctions

Whole module refresh complete and module renamed Food Services

New content added covering cyber resilience reports and data collection

- Log Tickets: From content to billing, through to product, you can easily log an enquiry and our team will get back to you as soon as possible.

- Resources at your fingertips: Access tutorial videos and a selection of our latest checklists and whitepapers that can help you on your path to compliance.

- User Guides: We provide you with Excel Register, Online Portal and Community Portal user guides, helping you get the most out of our solution!

- Access to your alerts, obligations, and tools all on one platform;

- Expanded search functionality;

- Modules grouped by country and industry;

- Simple navigation between obligations, alerts, and tools; and

- Ability to export all your data into Excel.

Does your organisation comply with the State and Territory-based licensing requirements for the supply of therapeutic goods? Authored in partnership with Kelly Griffiths, Partner at Gadens and Legal Expert for LexisNexis Regulatory Compliance, this checklist has been designed to help you identify your requirements related to the management and supply of therapeutic goods in Australia. This checklist covers classification of therapeutic goods, licensing and sampling requirements, advertising of therapeutic goods and more. Gain clarity on your therapeutic goods obligations and download the checklist today!

Bank and Non-Bank Deposit Takers Checklist

With content taken from the Bank & Non-Bank Deposit Takers compliance register, this checklist guides you through key governance, prudential and reporting obligations of both banks and NBDTs. You’ll understand the licensing and registration processes that allow financial institutions to operate in the New Zealand market, along with the source and scope of prudential requirements and understand how to meet them.

Andrew Ham, Partner, Hunt & Hunt Lawyers

Andrew has over 25 years’ experience as a financial services lawyer in Australia and the USA, and is an expert in the law of banking and regulated financial services, credit and consumer law, anti-money laundering, and privacy. He has assisted a broad range of bank and non-bank lenders and other financial services providers with their legal and compliance needs, working both in-house and as an external adviser. His clients have included global brands, and some of Australia’s largest banks and financial institutions, as well as start-ups and SMEs. As well as the banking industry, his experience encompasses non-bank lending from vehicle finance to ‘buy-now-pay-later’, as well as life and general insurance, remittance and other payments services, fintech, gambling, investment funds, and financial advice.

Andrew’s extensive in-house experience in organisations of all kinds and cultures gives him a unique perspective on the need for practical solutions to the regulatory issues faced by the Australian financial services industry. He is known for providing helpful and down to earth advice that focuses on practical solutions to the issue at hand. In particular, Andrew has a passion for bridging the gap between legal ‘advice’ and compliance or commercial ‘reality’ with sensible advice in plain English and compliance policy or procedures that are not only fit for purpose but embed the legal and compliance principles into everyday business processes.

Andrew’s expertise and experience includes:

| • | Financial services product documentation. Terms and conditions, loan security, and regulatory disclosure documents |

| • | Compliance frameworks, policy and procedure. |

| • | AML/CTF Programs. Development. Implementation and training. Independent reviews |

| • | Compliance and licensee reviews and due diligence reports |

| • | Advising on and implementing regulatory change |

| • | ASIC and AUSTRAC liaison. Licence Applications. |

| • | Compliance Training programs |

Andrew is a contributing author for the Lexis Nexis Regulatory Compliance service, is a Deputy Chair of the Financial Services Committee of the Business Law Section of the Law Council of Australia and chairs the Governance Risk and Compliance Institute’s AML/CTF Discussion Group.

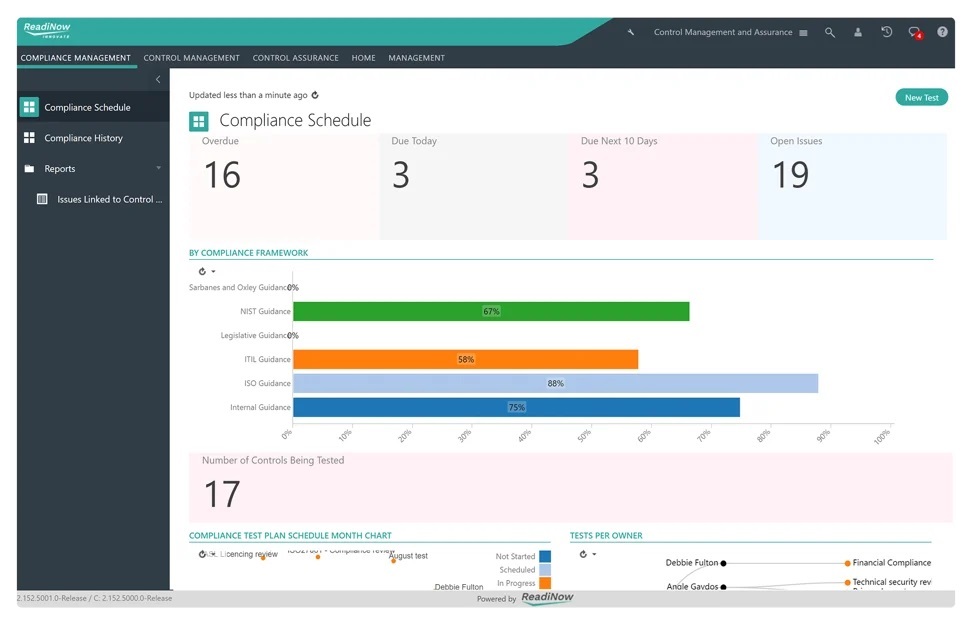

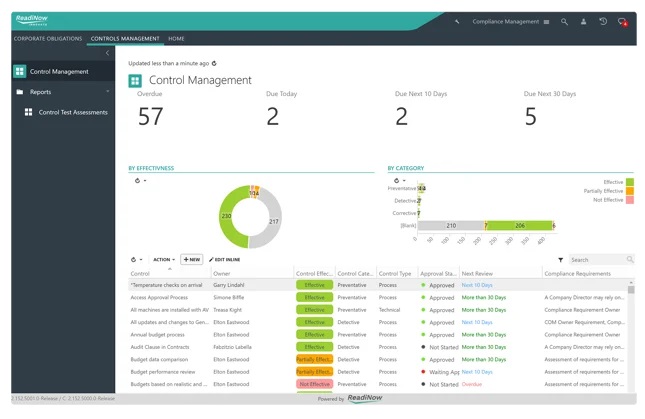

Compliance Framework

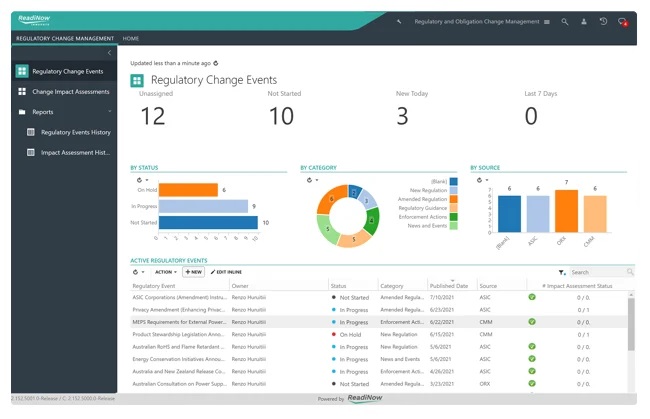

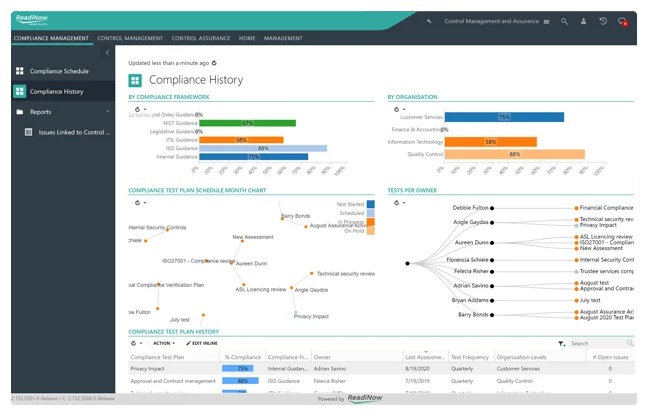

Proactively create a corporate compliance framework to methodically document and record objectives. Define compliance test plans and owners with the ability to link to corporate obligations.

Monitor Compliance Levels

Improve the connection between external compliance requirements and internal control activities to ensure your organisation has measures in place to meet your obligations in real time. Define due dates and configure reminders and alerts for plans that are due or overdue.

Automate Regulatory Updates

ReadiNow integrates with LexisNexis Regulatory Compliance. You can have peace of mind that updates are being pushed to the system automatically so you can proactively manage your compliance.

Reporting

Empower decision-making at all levels with detailed reports of your key business insights, including trend analysis. Design your own smart forms, dashboards, surveys, screens, reports, charts and graphs equipped with drill-down capabilities.

Navigating the Challenges of AI Regulation

Artificial intelligence is transforming business and revolutionizing industries in ways we've never seen before. From powering voice assistants like Siri and Alexa to advancing healthcare through innovative diagnosis tools, AI is analysing data, identifying patterns, and making decisions faster and more accurately than humans alone.

But with rapid advancement comes complex challenges. How do we ensure this powerful technology is deployed responsibly?

Find out in our latest whitepaper, Navigating the Challenges of AI Regulation. Discover the current state of AI regulation globally, proposed frameworks for developing ethical AI, and what the evolving regulatory environment means for your business.

- How to manage change in a dynamic regulatory landscape

- Dynamic approaches to understanding SOCI regulation with a deep dive into SOCI's essential requirements

- Foundational pillars of SOCI compliance through Critical Infrastructure Risk Management Program (CIRMP)

- AI-powered strategies for success… and more!