Commenced on 1 October 2023, this Act replaces the Public Interest Disclosures Act 1994 (NSW) to afford protection to persons who make public interest disclosures, and to provide for rules on making and dealing with disclosures. The Act also makes it an offence to take detrimental action against a person based on the suspicion, belief or awareness that they have made a public interest disclosure.

Partially commenced on 14 December 2023, this Amendment Act amends, among others, the Fair Work Act 2009 (Cth) and Work Health and Safety Act 2011 (Cth) to improve the workplace relations framework in relation to a variety of matters including the bargaining framework, workplace delegates, job security for casual employees, discrimination against employees subject to family or domestic violence and others.

Fully commenced on 13 December 2023, this Act creates a new Commonwealth anti-corruption agency, the National Anti-Corruption Commission (NACC), which is responsible for investigating serious or systemic corruption in the Commonwealth public sector. It also provides for powers of the Commissioner as the head of the NACC, as well as functions of the NACC and related matters.

Further commenced on 1 November 2023, this Act introduces a circular economy in Victoria and establishes a regulatory framework for waste, recycling and resource recovery services. The Act also sets out a container deposit scheme to be managed by the Head, Recycling Victoria, and data collection and reporting requirements to be met by reporting entities.

Fully commenced on 11 October 2023, this Amendment Act amends the Telecommunications Act 1997 (Cth) to improve the operation of information disclosure provisions. It also addresses a range of matters relating to information disclosure and national interest, including to facilitate assistance provided by the telecommunications industry to law enforcement agencies and emergency service organisations.

Partially commenced on 24 October 2023, the Amendment Act makes several amendments, including to extend criminal liability for gross negligence or reckless conduct to an individual acting as an officer of a person conducting a business or undertaking. It also provides for compliance requirements for prohibited asbestos notices and increases maximum penalties for a variety of offences under the Work Health and Safety (WHS) Act 2011 (NSW) and the Work Health and Safety Regulation 2017 (NSW).

Commenced on 7 November 2023, the Amendment Act extends the list of presumptive cancers for fire-fighters, to include an additional nine types of cancer (and their qualifying period) to the list of diseases for which there is presumption of cause under the Workers Rehabilitation and Compensation Act 1988 (Tas).

Fully commenced on 1 November 2023, the Amendment Act confers eligibility to Medicare benefits for disadvantaged patients who have been unable to access treatment before reaching age 22, or those who have had their treatment delayed beyond age the age of 22, for example due to COVID-19. It also improves Medicare access for patients with cleft and craniofacial conditions.

Commenced on 16 October 2023, this Act supports the establishment of the new Inspector-General of Aged Care (Inspector-General) to provide independent oversight of the aged care system. The Act sets out the Inspector-General’s key functions and powers, information gathering responsibilities and limitations, as well as compliance and enforcement provisions.

Commenced on 9 November 2023, this Act sets out waste requirements for businesses and forbids the supply of prohibited products, providing power for authorised persons to enter property and seize things which are considered prohibited products.

Commenced on 1 November 2023, this Act modernises and consolidates electricity safety legislation in the Northern Territory. It sets out safety requirements for all electrical goods and introduces a licensing scheme for persons that perform electrical work. The Act further outlines the grounds for disciplinary action and compliance/enforcement measures, among others.

Further commenced on 4 November 2023, the Act now makes an officer liable for corporate offences under the Biodiversity Conservation Act 2016 (WA) involving cetacean or threatened fauna, threatened flora, and other related offences that affect flora and fauna.

Fully commenced on 1 January 2024, this Amendment Act amends the Fair Work Act 2009 (Cth) and other related legislation to protect a range of worker entitlements relating superannuation, access to unpaid parental leave, work status of migrant workers, and casual employees working in the black coal mining industry.

Fully commenced on 1 January 2024, this Amendment Act makes a range of amendments to modernise communication methods available to consumers, businesses and regulators when interacting with each other, simplify the navigability of Australia's financial services laws, and make other miscellaneous and technical amendments to Treasury portfolio legislation.

Partially commenced on 1 January 2024, this Amendment Act makes a range of amendments to clarify and expand the law regarding vacant residential land tax in Victoria, including the conditions and exemptions of land tax and windfall gains tax rates and the Build-to-Rent special land tax formula.

Partially commenced on 1 January 2024, this Amendment Act amends the Fair Work Act 2009 (Cth) and other related legislation to protect worker entitlements, including a new entitlement to superannuation contributions in the National Employment Standards , to address gender inequality and to remove unnecessary administrative burdens.

Fully commenced on 1 January 2024, this Amendment Act makes a range of amendments to clarify legal and procedural issues regarding the Victorian Aboriginal Legal Service (VAL) and the Victorian Civil and Administrative Tribunal's jurisdictional, including the requirements provided for the investigating officer when notifying VALS.

Commenced on 1 January 2024, this Act replaces the Disability Services Act 1986 (Cth) and establishes the legislative framework for the funding and regulation of programs targeted for the benefit of people with disability, their families and carers.

Partially commenced on 1 February 2024, this Amendment Act amends several Acts to create a new offence relating to abusive behaviour towards current and former intimate partners and provide for a new definition of domestic abuse. The Act introduces the coercive control offence and provides which acts constitutes abusive behaviour and domestic abuse towards a child.

Fully commenced on 13 February 2024, this Amendment Act amends several Acts to reduce and remove regulatory burdens on businesses, reduces red tape, increases efficiencies and makes it easier and simpler for business to operate in the Northern Territory.

Partially commenced on 19 February 2024, this Amendment Act amends several Acts to strengthen the regulation of lobbyists and lobbying activities and enhance the independence of core integrity bodies.

Fully commenced on 1 January 2024, this Amendment Act amends the Higher Education Support Act 2003 (Cth) to improve the quality, accessibility, affordability and sustainability of higher education by acting on the priority actions of the Australian Universities Accord Interim Report. The Act allows First Nations students to be eligible for Commonwealth supported places in demand-driven high education courses.

Fully commenced on 1 February 2024, this Amendment Act makes several amendments regarding the road user charges payable for electric vehicles, including plug-in hybrids, and the circumstances when a person is not entitled to claim the principal place of residence exemption in relation to land.

Partially commenced on 19 February 2024, this Amendment Act amends several Acts to facilitate the transition of certain regulatory services from the Department of Transport and Main Roads to the National Heavy Vehicle Regulator, and improve road safety, streamline administrative processes, and clarify existing requirements.

Commenced on 7 January 2024, this Amendment Act makes several amendments to the law regarding migrant worker protections, including the power of immigration officers to access employment records, the prohibition of persons convicted of migrant exploitation or trafficking of persons from managing or directing a company, and new employment infringement offences and their equivalent penalties.

Partially commenced on 23 February 2024, this Act revokes and replaces the Resource Management Act 1991 (NZ) to provide an integrated framework for regulating both environmental management and land use planning, and enable the use and development within environmental limits and targets.

Commenced on 1 January 2024, this Amendment Act revokes the Land Transport (Clean Vehicle Discount Scheme Charges) Regulations 2022 (NZ) to amend a range of Acts, including the Land Transport Act 1998 (NZ), to provide for obligations concerning winding up of clean vehicle discount scheme.

Fully commenced on 1 March 2024, this Act establishes a new regulatory regime for Financial Market Infrastructures, including those relating to required contingency plans and entities subject to statutory management.

Energy market participants must comply with significant requirements and procedures in accordance with legislation designed to ensure the quality of energy generation, distribution and transmission in Australia for consumers. Wholesalers including distributors, transmitters and generators, their employees and authorised individuals are expected to be familiar with the broad landscape of legal and regulatory obligations that apply, as well as more specific obligations relevant to the particular sector in which they are operating. The Energy Wholesale module equips customers with knowledge of their requirements under the National Electricity and National Gas Laws and Rules and the relevant systems and processes that should be implemented to ensure an effective compliance management system within their organisation.

The regulatory framework for Therapeutic Goods and Medical Devices in Australia involves a comprehensive process of assessment, registration, and post-market surveillance to ensure the safety, quality and efficacy of therapeutic goods. The Therapeutic Goods Administration (TGA) assesses, grants approval and lists/registers therapeutic goods on the Australian Register of Therapeutic Goods (ARTG). The ARTG acts as a comprehensive database providing information on therapeutic goods' safety, efficacy and quality to healthcare professionals, consumers, and other regulatory authorities. The TGA also conducts post-market surveillance to monitor the safety of therapeutic goods, enforces compliance with regulatory standards, and provides ongoing guidance and information to sponsors of therapeutic goods, including healthcare professionals and the public. This module provides a comprehensive overview of the regulation of therapeutic goods in Australia, covering key topics such as the classification of therapeutic goods, licensing and sampling requirements, advertising of therapeutic goods, and the responsibilities of sponsors in the import, export and manufacturing of therapeutic goods. The module also delves into risk management plans, pharmacovigilance and biovigilance systems, and reporting adverse events, offering a holistic understanding of therapeutic goods in the healthcare industry. It provides guidance on the necessary policies and procedures to ensure compliance with the organisation’s legal responsibilities.

The NSW Water Supply Management module provides direction and guidance to water suppliers, retailers and utilities on the procedures and processes necessary to ensure compliance with their legal obligations throughout the operational system. The management of New South Wales’s water supply sector is regulated by various federal and state government departments which each have the responsibility for administering particular pieces of legislation. However, due to the complex nature of water supply operations, there are significant areas of overlap between departments. Accordingly, this module also covers the obligations of the regulators including what authority they have and how it is enforced.

The New Zealand Facilities Management module provides guidance for New Zealand organisations that own, occupy or control workplaces, public premises, electrical installations and works, gas and LPG systems, water systems, waste systems and facilities, car parks, major hazard sites and heritage sites. The module covers how facility owners, operators, and managers are obligated to coordinate with various government agencies to achieve compliance with applicable legislation. This includes working with WorkSafe NZ during investigations and inspections, providing evacuation schemes and other required information to Fire and Emergency NZ, collaborating with local councils for consent and certification processes and coordinating with regulatory bodies such as the Environmental Protection Authority when managing hazardous substances, or Heritage New Zealand for sites of cultural significance.

New content was added to cover international treaties and agreements relating to copyright.

New content was added to cover ICT requirements, information systems vulnerability and patch management, audio-visual security, ICT certification and accreditation, media protection and physical security requirements under the DSPF.

New content was added to cover section 8A of the Motor Accident Injuries Regulations 2017 (NSW) which sets out the matters that must be considered when assessing if the explanation for filing a claim after 28 days was full and satisfactory.

New content was added on breach reporting as set out in ASIC RG 132.

New content was added to cover the requirements under ASIC Class Order [CO 14/1262].

New content was added to cover the requirements under Part 6 Div 6.7 of the Superannuation Industry (Supervision) Regulations 1994 (Cth).

Content was updated to include carve outs for financial services and exceptions.

All State Government modules were updated to include public sector employers' obligations pertaining to psychosocial risks in the workplace.

A new set of obligations were added to provide coverage of the regulation of engineers practising in Australia, including requirements on qualifications, registration, professional indemnity insurance, continuing professional development and disciplinary action and professional conduct.

The existing obligation on the TCP code has been converted from a sub obligation to a new core obligation. The content has been substantially revised to provide detailed coverage of the functional chapters of the Telecommunications Consumer Protections Code.

New content has been added to cover an insurer's obligation to notify Medicare and Centrelink of certain compensation pay-outs to ensure recovery of eligible Commonwealth benefits.

New content was added to cover the National Blood Authority and its role in the development of the Australian Health Service Safety and Quality Accreditation Scheme in relation to blood management. Additional offences under the Drugs Misuse Act 1986 (Qld) were also included.

New content was added to provide dedicated coverage of Better Advice Act requirements in respect of tax (financial) advice services.

New content was added to provide dedicated coverage of the requirements in relation to the insured's duty to take reasonable care not to make a misrepresentation for consumer insurance contracts.

New content has been added to cover specific requirements and exemptions for providers of managed discretionary accounts under ASIC Corporations (Managed Discretionary Account Services) Instrument 2016/968 and RG 179 Managed discretionary accounts.

New content has been added to distinctly capture the information regarding local governments' obligations in relation to gas pipelines and other authorised activities on local government lands.

New content has been added providing coverage of the requirements for the use of laser and laser pointers by organisations, including obtaining permits or exemptions.

New content has been added to provide targeted coverage of the Norfolk Island state services partnership.

New content on accreditation requirements for accredited data recipients.

New content on has been added on reporting requirements for foreign persons (and their partners) under the Foreign Acquisitions and Takeovers Act 1975 (Cth).

A new set of obligations have been added to cover the requirements under the Insurance Brokers Code of Practice.

We have enhanced our content to provide greater coverage of the Indigenous Procurement Policy.

New sets of obligations have been added to cover responsible lending requirements for credit card contracts.

New obligations were added on Two-up in NSW and Gaming equipment in Queensland. We also enhanced our coverage of the Security Providers Regulation 2008 (Qld) and the Brisbane Casino Agreement Act.

New coverage was added of the Guidelines for Heliports, National Health and Medical Research Council Guidelines, Guide, hearing or assistance dogs, the National Injury Insurance Scheme, pathology reporting to the National Cancer Screening Register and prescribed vaccination reporting to the Australian Immunisation Register.

A new set of obligations have been added to provide more granular coverage of the requirements for engaging in debt collection activities under RG 96 and the National Consumer Credit Protection Act 2009 (Cth).

A new set of obligations have been added to cover the requirements under the AFIA Online Small Business Lenders Code of Practice.

A new set of obligations have been added to cover the data reporting requirements for RFCs/non-ADI lenders.

A new set of obligations have been added to cover the community consultation obligations under Part 2 Division 2, the staffing obligations under Part 2 Division 3, and the code of conduct obligations under Part 2 Division 4 of the Ports Authority Act.

A new set of obligations have been added to provide dedicated coverage of the requirements for complying with the Financial Services Council Standards and guidance notes.

A new set of obligations were added to the Sanctions module to cover the United Kingdom sanctions regime as it affects New Zealand organisations. We also expanded our coverage of EU Sanctions as they relate to New Zealand organisations interacting with EU entities.

New content has been added about the duties of directors and senior managers of creditors. Content about disclosure requirements in relation to dispute resolution schemes and financial mentoring services and debt collection has also been added.

New content was added to cover climate reporting entities pursuant to the Financial Markets Authority: Guidance for keeping proper climate-related disclosure records.

New content was added to cover relevant obligations imposed by the Natural Hazards Insurance Act 2023 (NZ) which will come into force on 1 July 2024.

- Access your alerts, obligations, and tools all on one platform;

- Expanded search functionality;

- Modules grouped by country and industry;

- Simple navigation between obligations, alerts, and tools; and

- Ability to export all your data into Excel.

Does the organisation that is engaged in child-related roles or industries in Australia comply with the relevant state, territory and Commonwealth laws, standards, policies and procedures in order to ensure child safety?

This checklist has been designed to help organisations that are engaged in child-related roles or industries in Australia, identify their compliance requirements related to child safety in Australia. It has been developed in conjunction with LexisNexis® Regulatory Compliance Legal Expert, Patrice Fitzgerald, Principal Lawyer and Director at Safe Space Legal.

Energy – Wholesale Markets [AU]

Does your organisation understand the legal and regulatory wholesale energy obligations they must comply with?

This checklist has been designed to help organisations understand how to navigate and comply with the legislative and compliance requirements related to quality of energy generation, distribution and transmission in Australia for consumers. It has been developed in conjunction with LexisNexis Regulatory Compliance Legal Experts, Caren Klavsen, Special Counsel at Piper Alderman and Andrew Rankin, Partner at Piper Alderman.

Workplace Health and Safety Checklist [NZ]

In today's dynamic business environment, maintaining a focus on workplace health and safety is not just a legal obligation but a strategic necessity. Tracking your obligations can be as complex as the reason the legislation exists, which is why we’ve developed this new checklist to help you forge a clear path to compliance.

Developed by our team of legal experts, this checklist provides you with guidance on your compliance obligations, to ensure your business is meeting its workplace health and safety requirements from first aid to risk and hazard management.

Financial well-being is a principle both consumers and lenders can get behind when it comes to retirement. But with more legislative changes for the financial sector looming, identifying and adopting your crucial compliance obligations as a KiwiSaver scheme provider will be a key factor in being able to respond to those changes.

Content for this checklist has been carefully curated by our legal expert Tania Goatley, Partner at Bell Guley from the KiwiSaver compliance register and provides guidance through nine essential topics to help you navigate the legislative landscape.

Whether you are a new entrant or an existing provider in the KiwiSaver market, this checklist is a valuable tool to get you on a clear path to compliance.

Global Banking Checklist [ALL]

Are the governance arrangements, risk management apparatus, compliance assurance function, and financial crime prevention mechanisms of your bank strong enough to operate anywhere in the world?

Authored in conjunction with Martin Polaine, Barrister at Brooke Chambers and Legal Expert for LexisNexis Regulatory Compliance®, this checklist helps banks to identify their global banking compliance requirements. It covers Banking Governance and Standards, Capital Requirements, Leverage and Liquidity Requirements and more..

Temogen Hield, My General Counsel

DOur founder, Temogen Hield is an expert in counselling growing businesses. Having served as a partner in an international law firm, including work in China, and as a General Counsel in both large and medium-sized businesses, he possesses extensive industry-leading legal expertise.

In addition to his legal experience, Temogen has held c-suite leadership roles in technology and payments, and has firsthand founder experience in technology start-ups. This unique combination of legal, business, and start-up knowledge allows Temogen to provide growing businesses with the legal expertise and the strategic counsel they need to thrive. His counsel is known for being decisive, practical, and tailored to the specific challenges faced by growing businesses in today's dynamic landscape.

Temogen is the legal expert for our FINANCIAL SERVICES INDUSTRY portfolio in Australia.

What is corporate compliance?

Corporate compliance is an important element of your business. At its most basic level, a good compliance process ensures that you never find yourself breaching your regulatory requirements, or facing the organizational risks that could arise from a breach. Any breach could have far-reaching consequences, including lawsuits, fines and even criminal penalties.

What is compliance management?

Every business, in every industry, has specific rules, laws and regulations with which it mustcomply. These standards are set by government agencies, industry oversight groups or other regulatory bodies or internally by the organization. These requirements are referred to as corporate compliance, or governance, risk management and compliance. Non-compliance can be a risk to your ability to operate your business and achieve your business outcomes and desired goals. Compliance management then is simply the process for managing your compliance requirements.

Benefits of corporate compliance

There are benefits to being a compliant organization that go far beyond mitigating negative consequences. Compliant organizations tend to have an excellent company reputation. They are on the forefront of industry innovations and trends. They have more efficient, replicable and streamlined processes. And they empower employees to take ownership of their decisions andrapid actions based on those decisions.

What is a compliance management plan?

Your compliance management plan is essentially the framework that you put in place toidentify, monitor and manage your compliance risks and obligations. It starts with identifyingyour obligations and completing a risk assessment. Then you’ll need to incorporate systems,policies and procedures to backstop those risks and obligations. And finally you’ll need to ensure that the right stakeholders have access to timely and accurate reports and information.

Operational Resilience Outlook 2024 Report

As Boards and senior management teams come under more pressure for operational resilience, cultivating a resilient culture is as important as the systems in place for your organisation.

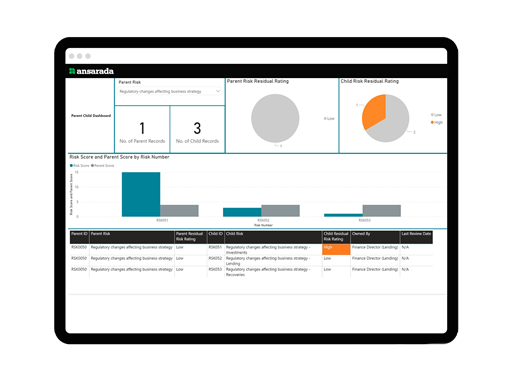

We’ve collaborated with our technology partner Ansarada to deliver the "Operational Resilience Outlook Report 2024" – Your ultimate compass for navigating the intricate landscape of business resilience in the upcoming year.

Ansarada conducted an extensive survey within the GRC and risk management communities to deliver a report that delves deep into the nuances of operational resilience, empowering you with invaluable insights and strategic foresight for 2024 and beyond.

- Explore the complexities of the State and Federal legislation

- Dissect the challenges of operating across State lines

- Show you how you can manage your existing obligations while tracking and responding to regulatory change

- Why recent Worksafe NZ incidents resulted in over $300K in fines and reparations

- Changes to legislation that directly affects your WHS program, and your organisation's liabilities as it pertains to these changes

- Practical steps you can take to make your WHS management system airtight and avoid added costs when accidents happen, and much more!